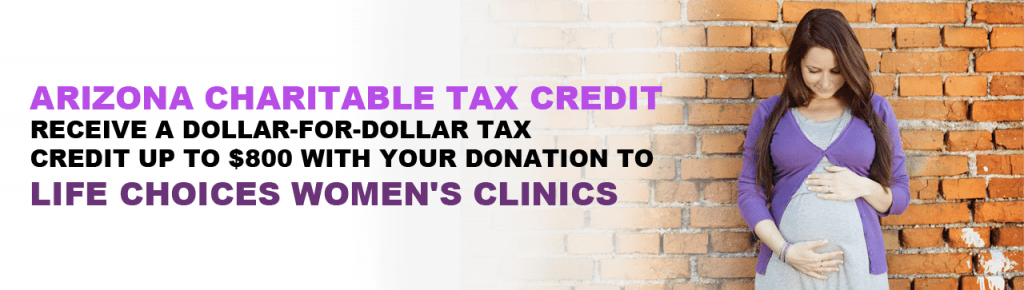

2023 AZ Charitable Tax Credit donations made from January-December may be claimed for the 2023 tax year.

In addition, donations made before the April 15th, 2024 tax filing deadline may be applied to either the 2024 tax year or claimed for the previous tax year 2023.

What is the Arizona Qualified Charitable Organization Tax Credit?

Formerly called the Working Poor Tax Credit, the QCO Tax Credit is available to anyone who files an Arizona tax return, and allows taxpayers to claim a dollar-for-dollar tax credit on AZ state taxes owed. To receive the QCO tax credit, you must make a donation to a Qualified Charitable Organization, have an AZ state tax liability, and file an Arizona tax return claiming this credit.

- You can claim you donation as deduction on your federal tax return.

- When filing AZ tax return, you do not have to itemize to take this tax credit.

- You can take the QCO credit exclusive of credits to public schools, private schools, foster agencies and other tax credits.

You may be able to offset your 2023 or 2024 Arizona taxes by taking a tax credit up to $421 if filing as single or $841 if filing as married. Amounts lower than these $421/$841 maximums also qualify up to your tax liability. This is a dollar-for-dollar tax credit! Just complete and file Arizona state tax forms 301 & 321 to claim this tax credit. You can take advantage of the QCO tax credit along with other AZ state tax credits in the same year.

For Example:

- John and his wife Jane are filing their AZ tax return as a married couple. Their total Arizona tax liability was $2,500. They had $3,500 taxes withheld, so they are due an AZ state refund of $1,000. After making a $841 QCO donation to Life Choices Women’s Clinics, their AZ state refund is now $1,841.

- Sue, filing as a single taxpayer, had Arizona tax liability of $1,500. She had $1,100 taxes withheld, but still owes $400. After making a $400 donation to Life Choices Women’s Clinics, Sue does not owe anything to AZ state when she claims this $400 QCO tax credit.

.

Make a donation to Life Choices Women’s Clinic.

File your taxes and claim the credit by using AZ Form 321.

(Use our assigned QCO Code 20439)

Receive the Tax Credit.

(Up to $421 filing single and Up to $841 filing joint)

Feel GREAT about helping mothers and saving families.

For more information on the Arizona Charitable Tax Credit visit www.azdor.gov. If you have any questions about making a QCO Tax Credit donation to Life Choices Women’s Clinic, please call Sheila at 602.502.3520, or send her an email at [email protected].

Frequently Asked Questions:

Q: How do I qualify for Arizona Qualified Charitable Organization (QCO) tax credit?

A: If you make a monetary donation (cash, check, credit card payment) to Life Choices Women’s Clinic and you file an Arizona state tax return, you may qualify for the tax credit. Donations of clothing, food or other tangible items do not qualify.

Q: Can I take this QCO tax credit and other tax credits such as credit for donations to schools and foster care agencies?

A: Yes, they are separate tax credits, and you can take advantage of all of them.

Q: What is the difference between a tax credit and a tax deduction?

A: A tax credit is significantly more beneficia than a tax deduction. A tax credit reduces your tax liability, dollar-for-dollar. A tax deduction reduces the taxable income upon which your tax liability is calculated.

Q: Do I have to donate $441 or $841 to claim the QCO tax credit?

A: No, you do not have to donate the whole amount, or make the donation all at once. Donations given throughout the year may qualify for the tax credit up to the maximum limits.

Q: Where can I get more information about the QCO tax credit?

A: You can get more information by visiting the Arizona Department of Revenue website or by calling Taxpayer Assistance at (602) 255-3381 or (800) 352-4090. Please consult with your Tax Advisor for specific questions as individual tax circumstances vary.

As the shelter in place order was established, Life Choices Women’s Clinic was ready to serve the community by implementing serious precautions in an effort to mitigate the spread of COVID-19. Our staff had the choice to self-isolate by working from home or coming to the clinic to work.

As the shelter in place order was established, Life Choices Women’s Clinic was ready to serve the community by implementing serious precautions in an effort to mitigate the spread of COVID-19. Our staff had the choice to self-isolate by working from home or coming to the clinic to work.

After a difficult night, knowing her baby was dying inside her, she remembered the Abortion Pill Reversal pamphlet she had received on the Hope Mobile Clinic and called the APR Hotline nurse. Debby helped her get started on progesterone, and referred her back to our clinic to continue her care. The progesterone had side effects, causing her tiredness and nausea.

After a difficult night, knowing her baby was dying inside her, she remembered the Abortion Pill Reversal pamphlet she had received on the Hope Mobile Clinic and called the APR Hotline nurse. Debby helped her get started on progesterone, and referred her back to our clinic to continue her care. The progesterone had side effects, causing her tiredness and nausea.